Lynne Kiesling

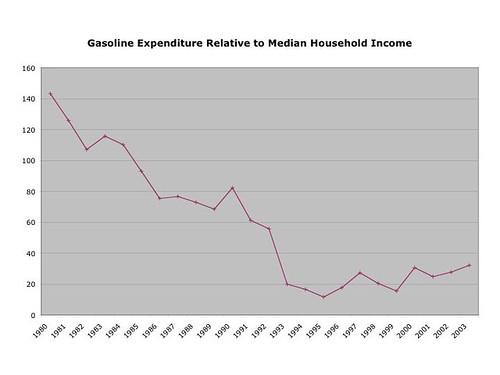

OK, Manhattan in hand … here’s an analysis that improves on the first one. I’ve taken the ratio of [gasoline price x gasoline quantity] to median household income. The gasoline quantity data are from Table 5.13a of the DOE’s Annual Energy Review 2004, in thousands of barrels.

Table 5.13a reports “estimated petroleum consumption, residential and commercial”. That means that I am overstating the amount of residential petroleum consumption, which at least will bias the results in the direction I want; if I’m overstating residential consumption, I’m overstating residential expenditure, so if it declines, then we know that in truth the decline is even larger than depicted. The analysis would be more precise if I could break them out. But here it is anyway:

If anything, this decline is larger than just the ratio of gas price to median household income. Interesting.

Looks good, however, without knowing the ratio of residential to commercial petroleum consumption, it’s actually not that helpful. Given the decline in the manufacturing sector, it would be reasonable to assume that the commercial share of petroleum consumption has also declined, meaning that the decline is probably flatter, at the very least. Any way to get the breakout numbers?

A Tale of Two Graphs

A couple of days ago I wrote a post about how the price of gas, when adjusted for inflation, is cheaper today than it was 25 years ago. Here's some numbers to back it up. First there's this post over at Knowledge Problem, which charts "t…

I think the data you want (household expenditures on gasoline) are buried somewhere in here:

http://www.bls.gov/cex/home.htm

Actually, wouldn’t the decline in manufacturing lead to an increase in petroleum consumption? Since items are not being made locally then they’re coming in from overseas and getting shipped to their various destinations. e-Commerce would also mean an increase in direct-to-consumer shipments as well.

Of course all of this analysis doesn’t assuage the consumer forking out $2.60+ for that gallon of gas. Especially when they keep hearing on the radio about how outraged their supposed to be over the situation.

The relative decline in manufacturing relates to the growth in imports (altho not in a simple linear way). The growth in imports is a factor in the current boom in railroad and truck transportation, getting stuff from port of entry to the consumer. This should mean growth of the commercial share of petroleum consumption.

The relative decline in manufacturing relates to the growth in imports (altho not in a simple linear way). The growth in imports is a factor in the current boom in railroad and truck transportation, getting stuff from port of entry to the consumer. This should mean growth of the commercial share of petroleum consumption.

What’s the Y-axis here? Is it telling us that in 1980, the gasoline expenditure was 140% of median household income? If so, that doesn’t make a lot of sense and may indicate a problem with your data or analysis.

Of course. That’s why I put the massive caveat in the body of the post.

I would not worry too much about not breaking out manufacturing vs. residential use. One is a direct cost and the other is an indirect cost we pay when we buy goods produced by industry. Sure, one might want to fiddle with it because of exports and imports, but that probably would not change much of anything as there is a global price for oil and we (the U.S.) consume a huge chunk of what we produce.

I would not worry too much about not breaking out manufacturing vs. residential use. One is a direct cost and the other is an indirect cost we pay when we buy goods produced by industry. Sure, one might want to fiddle with it because of exports and imports, but that probably would not change much of anything as there is a global price for oil and we (the U.S.) consume a huge chunk of what we produce.

This chart tracks exactly the spot price of oil as it started its collapse in 1980 and continued though the 80’s as consumption started to catch up in the early 90’s.

I’m not sure what the point is that you’re trying to make in this post, that the price of oil has fluctuated over the last 20 years? Hardly news. If the chart went back to the years before the US domestic peak production year of 1970 it might be illuminating.

If you go to bea.gov and look at the data on personal consumption expenditures you will find the data to construct a series of nominal expenditures on energy as a share of total personal consumption expenditures. The deflated real data just goes back to about 1990.

the chart will show it rose from about 6% of PCE

in 1970 to about 9% in 1980. From 1980 to 2000 it fell to close to 4%. since 2000 it has rebounded to just under 6%.

I can send your the data if you want.

I found some data on household transportation fuel use at the following link:

http://www.eia.doe.gov/emeu/rtecs/nhts_survey/2001/index.html

Unfortunately it only goes up to 2001, but what is there (combined with some median income data and gasoline price data I found elsewhere) shows the following:

In 1988, the median household spent 1.48% of its income on gasoline.

In 2001, the median household spent 2.5% of its income on gasoline.

This would seem to contradict the point you were trying to make.

The Fundamentals Are Basically the Same: A Reprise of Last August’s High Gas Price Posts

Lynne Kiesling We leave on an intermountain West camping trip Saturday morning, so will be beyond the reach of communication technology for a fair chunk of the next week. But given that the underlying fundamentals have not changed substantially in…

The Fundamentals Are Basically the Same: A Reprise of Last August’s High Gas Price Posts

Lynne Kiesling We leave on an intermountain West camping trip Saturday morning, so will be beyond the reach of communication technology for a fair chunk of the next week. But given that the underlying fundamentals have not changed substantially in…