Lynne Kiesling

At Grist, Sean Casten muses on the macroeconomic implications of trends in electricity consumption. His musings focus on the established correlation between electricity consumption and economic activity, an association that he fleshed out in an earlier post. In these two posts he looks at trends in residential, commercial, and industrial electricity consumption over the course of 4 different recessions, to see if this one differs from earlier ones. In particular, he’s wondering why this past summer’s residential consumption, measured in millions of megawatt hours, were at an all-time high:

I’m at a loss to explain the residential data. Pre-recession, we had too many homes, easy credit, rapid construction, booming demand for plasma TVs and other consumer electronics … I get why all that leads to rising residential electric sales. But the data is showing that as of this summer, we were at all time highs for residential electric sales. Maybe there’s a seasonal impact, but all these data-points are on a trailing-12-month basis, so that can’t be a huge effect. I’m at a loss to square that with housing vacancy rates, unemployment and slower consumption. Any ideas?

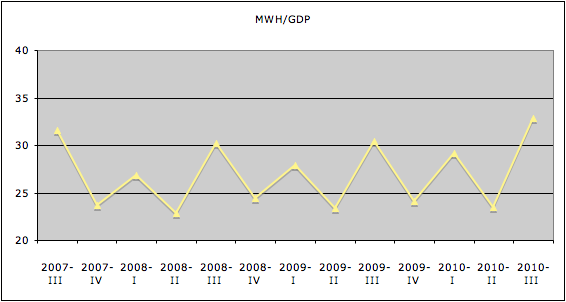

My thoughts start with looking differently at the data. Frankly, I don’t find single-variable time series data particularly informative — there are too many variables that go into determining aggregate residential electricity consumption. Such variables include weather, household income, number of electricity-consuming devices, efficiency of said devices, and the price of electricity. For that reason, I chose instead to look at residential electricity consumption per dollar of GDP. Short of doing an econometric analysis that controls for all of these other variables, looking at MWH consumed per dollar of GDP gives us some (albeit rough) indication of whether or not that electricity consumption is directly associated with increased value of economic activity. If that ratio is higher, then it’s less likely that the electricity consumption is associated with increased value of economic activity.

For electricity consumption I used the same EIA data as Sean, although I did not take a 12-month trailing average. For GDP data I used the BEA’s quarterly real GDP in chained 2005 dollars. One caveat: the GDP data are seasonally adjusted, while the electricity data are not, and you can see the seasonality of residential electricity demand in the graphs I’m going to present (higher demand in QI and QIII, due to heating and cooling respectively). Note also that GDP data are not available monthly, so I aggregated the monthly electricity consumption data up to quarterly data.

Lots of graphs below the cut …

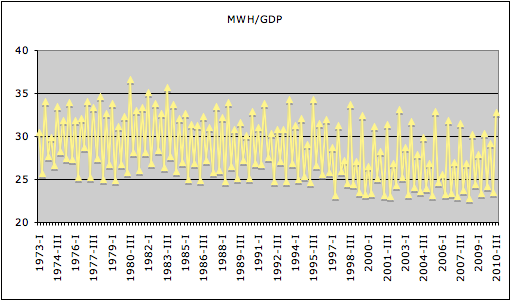

Here’s the whole series, QI1973-QIII2010; note the seasonality evident in the pattern. The average ratio for the whole period is 28.47, and the standard deviation is 3.63, which means that two-thirds of the observations fall between 24.84 and 32.1 (I’ll use this range in a second to interpret the most recent recession):

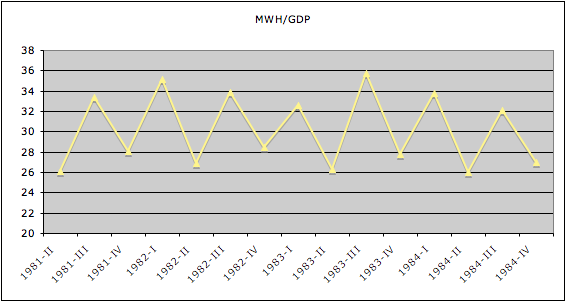

Here’s what the early 1980s recession looks like, with not much of an underlying pattern other than the seasonality, average ratio 30.20:

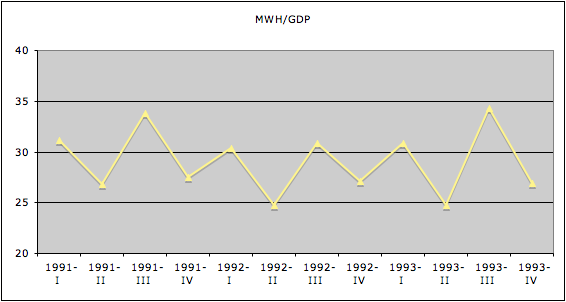

Here’s the early 1990s recession, average ratio 29.08:

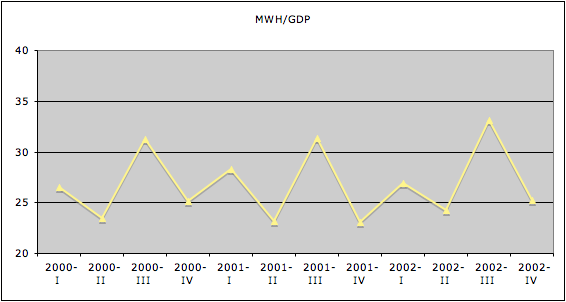

Here’s the early 2000s dot-com recession, average ratio 26.80:

And here’s the officially-ended-but-still-not-very-jobby just finished recession, average ratio 26.99:

I find it difficult to make any substantive inferences other than the strong seasonality in winter and summer of residential electricity consumption, with two exceptions. First, the average residential consumption per dollar of GDP is substantially lower in the last two recessions than in the 1980s and 1990s recessions. That’s interesting, and may indicate a structural improvement in residential energy efficiency with respect to electricity consumption. Second, I think Sean is right to look at how high QIII 2010 residential consumption is — it’s even high in a consumption-per-dollar of GDP sense (the QIII 2010 ratio is 32.82). 32.82 is slightly more than one standard deviation above the mean of the entire series, and it’s nowhere near the highest ratio of 36.63 in QIII 1980, but it is high.

What are some reasons for such a high MWH/GDP ratio in residential consumption? Let’s revisit that initial list of variables — weather, household income, number of electricity-consuming devices, efficiency of said devices, and the price of electricity. Sean refers to the increasing number of consuming devices, but they are also more energy efficient than in earlier recessions, which is a mitigating factor. Weather was not an aggregate unusual factor in summer 2010. That leaves us with the standard microeconomic price theory variables — income and price. In most regions of the country the idea of a residential retail price effect is laughable; most residential customers pay regulated prices that are fixed at rates that don’t reflect true summer peak opportunity costs, so the seasonal increase in quantity demanded is not mitigated by any dynamic price. If anything the nullification of a change in price subsidizes that seasonal consumption, and induces people to substitute out of the consumption of other goods and into the consumption of goods that use electricity.

The income effect is more complicated. Yes, unemployment and lower housing values reduce incomes, which ceteris paribus would decrease electricity consumption. But if your reduction in income means that you are substituting out of other activities that are relatively more expensive, then we can think about sitting at home and watching DVDs and hanging out on the Internet as a Giffen good!

Furthermore, these simple data cannot reflect the extent to which the structural change in employment toward freelancing and self-employment has happened, particularly as an adaptation to the second half of a deep recession. If more people are working at home, that would increase residential electricity consumption.

I see this analysis as a cautionary note for those who want to draw too many inferences from single-variable time series data, because even just adding in one more dimension to the analysis makes it difficult to infer anything other than the seasonality of residential electricity consumption.

Interesting stuff, Lynne. And I take your criticism about overdrawn conclusions from single-data points. For what it’s worth, I’d only look at electric sales as an indicator of the economy under the assumption that energy use/GDP is relatively constant, which appears fairly consistent (at least over fairly short time periods) with your data, subject to seasonal adjustment. What troubles me from a macro perspective is the shifts in electric consumption between sectors, insofar as each recession seems to accelerate the shift away from value-added industrial/mfg sectors and towards residential/commercial. I’m far from the first to raise that concern of course, but it’s striking in the electric data how much each recession has accelerated that shift. It would be interesting to dig in and see why that happens; presumably out taste for manufactured goods doesn’t change. Perhaps it is the startup/shutdown costs associated with big industry? Barriers to entry/exit? Something else? Whatever the cause it seems one worth analyzing, to the extent one believes (as I do) that a healthy economy needs to retain an industrial core.

Very interesting information, thanks! Do you have any information about how is the residential electricity consumption influenced by modern technologies (solar panels, etc.)? For past decade governments in Canada and U.S. spent much effort to support alternative energy sources for domestic usage. I also wonder if consumption devices are somehow related to extreme weather conditions in some particular areas. Well, above all, there is no doubt that the energy consumption has an increasing tendency.