Lynne Kiesling

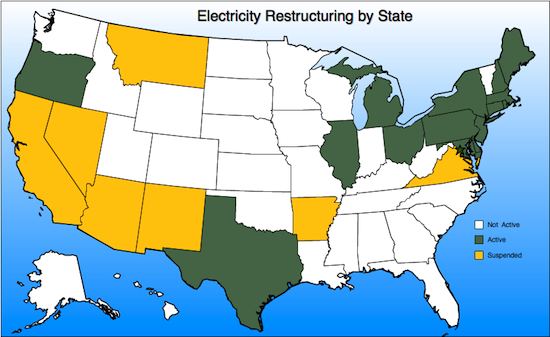

In 2011, roughly fifteen years after the passage of the first state-level electricity regulation restructuring legislation (in states like California, Pennsylvania, Maine, …), retail competition for residential customers remains anemic in most of the 15 states + DC that have implemented restructuring and allow retail choice.

Lots of possible theories exist for such weak competition — high customer acquisition costs, incumbent default service contracts as an entry barrier, regulation-mandated full depreciation of long-lived incumbent assets as a barrier to innovation, customer indifference, to name a few. Out of this set, the state where retail rivalry for residential customers has been most robust is Texas, with multiple retail firms offering a variety of traditional and green electricity products. At this point they are still competing primarily on price, not on product differentiation (such as dynamic pricing) other than green power, and not through bundling with other services to the home. If consumers value those products I expect them to develop as the distribution wires companies implement their digital meter installations, which will enable more variety and better information flow and customer engagement.

Based on my previous Texas work and on some reading I’ve been doing on the history of telephone regulation for a paper I’m working on, I want to explore another hypothesis: Texas has done a better job than the other 14 states + DC of quarantining the monopoly.

What does “quarantine the monopoly” mean? The phrase arises from the work of William Baxter, now a law professor at Stanford, who in his position as Assistant Attorney General in the U.S. Department of Justice in the 1980s was the primary architect of the settlement of the U.S. vs. AT&T case that led to AT&T’s divestiture in 1982. One of Baxter’s principal concerns regarding the welfare effects of the AT&T monopoly was what came to be known as Baxter’s Law, or the Bell Doctrine — “regulated monopolies have the incentive and opportunity to monopolize related markets in which their monopolized service is an input”, to quote Joskow and Noll’s outstanding 1999 paper on the Bell Doctrine. If there is sufficient rivalry or potential rivalry in that related market, then allowing monopolist participation in that market could reduce or stifle competition, enabling the monopolist to extend its monopoly into the related market, one result of which would be reduced output, higher prices, and deadweight loss arising in that related market.

Baxter’s argument was that the best feasible approach to such a situation, in which a regulated monopolist sits in the middle of a vertical supply chain with competitive or potentially competitive markets on either or both sides, is to quarantine the monopoly by restricting its market participation to its regulated functions. The best way to do this is to separate the ownership and control of the regulated functions from the other vertically-related functions.

Most of the restructured states in the US have failed to quarantine the monopoly in electricity. Regulated wires companies continue to participate in retail markets in states that have granted the default residential service contract to the incumbent, perpetuating the monopolist’s presence in the retail market. While they cannot use that contract to raise retail prices and hence raise their profits, their incumbency still provides an entry barrier in the retail market for residential customers, a market that already has substantial customer acquisition costs and a customer culture that is not yet accustomed to or aware of the potential value creation arising from novel energy-related services and bundles.

Texas, however, quarantined the wires monopoly very clearly in its implementation of restructuring. Incumbents were not permitted to provide default service in their native regulated territories, and they are only permitted to provide wires-related services, which includes metering. Texas has done a better job than the other states of applying the Bell Doctrine in electricity.

I have never understood why any incumbent would choose to be the default provider. In the states I have studied, the risks of being the default provider were intolerable for a regulated entity.

Hi Lynne,

You have resurfaced an old but always timely issue that is in synchronicity with Jesse Berts Smart Grid Talk Tuesday Topic Economy at risk: How electricity could save the U.S. from itself.

Next was my response:

Hint: Start With a Clean Slate, as I did, to Save the U.S. from Itself

As sort of a reengineering project of the power industry as a whole, the US needs to go back to when it made the huge architecting mistake, aka Open Transmission Access, as a result of the Energy Policy Act of 1992.

According to Bill Sweet blog post FERC Issues Major Rule to Encourage Grid Expansion, of July 29, 2011, in the digital edition of the IEEE Spectrum, together with Order 890, FERC Order 1000 “… represents the most important US Power Grid Reform since the system was opened to wholesale competition with order 888 in 1996.” Please take a close look at Order 1000 and ask: Is that a reminder of the need to start with a clean slate?

To save the U.S. from itself, I suggested last year the EWPC blog post Why the IEEE Smart Grid World Forum Requires Learning About T&D Transportation Ultraquality.