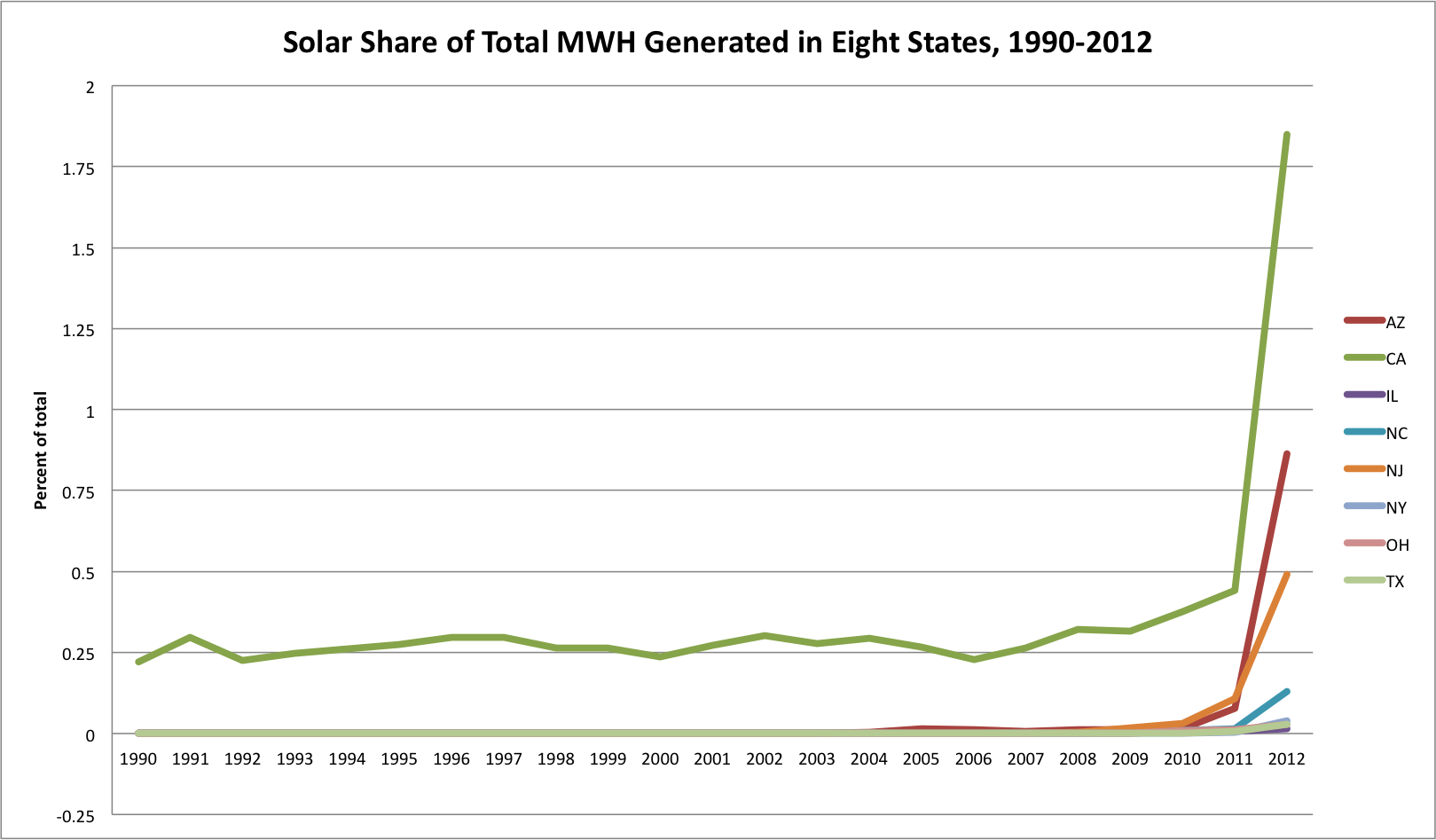

I’ve been playing around with some ownership type and fuel source data on electricity generation, using the EIA’s annual data going back to 1990. I looked at solar’s share of the total MWH of generated electricity in eight states (AZ CA IL NC NJ NY OH TX), 1990-2012, and express it as a percentage of that total, here’s what I got:

In looking at the data and at this graph, a few things catch my attention. California (the green line) clearly has an active solar market throughout the entire period, much of which I attribute to the implementation of PURPA qualifying facilities regulations starting in 1978 (although I’m happy to be corrected if I’m mistaken). The other seven states here have little or no solar market until the mid-2010s; Arizona (starts having solar in 2001) and Texas (some solar before restructuring, then none, then an increase) are exceptions to the general pattern.

Of course the most striking pattern in these data is the large uptick in solar shares in 2011 and 2012. That uptick is driven by several factors, both economic and regulatory, and trying to distentangle that is part of what I’m working on currently. I’m interested in the development and change in residential solar market, and how the extent and type of regulatory policy influences the extent and type of innovation and changing market boundaries that ensue. Another way to parse the data is by ownership type, and how that varies by state depending on the regulatory institutions in place. In a state like North Carolina (teal), still vertically-integrated, both the regulated utility and independent power producers own solar. The path to market, and indeed whether or not you can actually say that a residential solar market qua market exists, differs in a vertically-integrated state from, say, New Jersey (orange) or Illinois (purple, but barely visible), where thus far the residential solar market is independent, and the regulated utility does not participate (again, please correct me if I’m mistaken).

It will be interesting to see what the 2013 data tell us, when the EIA release it in November. But even in California with that large uptick, solar’s share of total MWH generated does not go above 2 percent, and is substantially smaller in other states.

What do you see here? I know some of you will want to snark about subsidies for the uptick, but please keep it substantive :-).

My gut (that I can’t prove) is that this is also at least partially due to the competitive environment for clean tech capital. Stipulate some fixed volume of capital that has the expertise/cost/patience to invest in energy projects in any year and then layer on top of that the changing regulatory environment for all techs and there may be an explanation here that has more to do with changes to non-solar regs. Certainly say in the early 2000’s a big boom in wind that didn’t correspond so much a change in wind regulation but rather the changes to PURPA in the 2005 EPACT. Those changes effectively made it impossible to lock in long-term power prices for CHP and other traditional clean tech sources, but you could still get that kind of revenue certainty from wind PTCs, at similar scale investments. As I said, I can’t prove that but I think at least a part of the pop in solar in 2011 could be explained (maybe?) as saturation in wind markets & spots looking for diversity. An interesting test of that hypothesis would be to look at the scale of the projects, insofar as the folks who make 8 – 9 figure investments aren’t going to do residential solar, but can pivot to utility-scale solar pretty easily.

Have you looked at whether each state has a portfolio standard? This could be a factor bumping up solar’s share; alternatively, a newly adopted (or binding) RPS could cause solar that had been there all along to be labeled as such, causing an apparent uptick.

Yep, that’s definitely one of the variables we are including. The residential-relevant solar policy space is very complicated. Lots of different instruments, which is why I call it a Rube Goldberg approach.

Lynne,

A few comments:

(1) Be careful about thinking that EIA data represents solar capacity. EIA only collects data on utility scale. Distribution side is not in these numbers. For that you need to go to SEIA for the most current numbers. That doesn’t matter quantitatively until the last few years, but last year for example, DG solar capacity added was 2GW.

(2) Related to this is that noone as far as I can tell provides generation for DG. EIA accounts for this in NEMS via some sort of simulated number that gets put into their EE calculation. How they groundtruth that estimate is unclear to me. If you happen to find out that I am wrong about this and that there is a good series for DG energy generated, please let me know. I could really use if for some things I’m working on.

(3) Minor point is that NJ has one of the only programs in the country that allows utility ownership of rooftop solar. An exception to the utilities can’t own beyond the meter rule that dates from the days when GE and ConEd were a single firm.

(4) My sense is that the growing importance of utility scale solar relative to wind during this time interval has more to do with falling cost of PPAs for new projects as opposed to saturation in the wind market. Most RPSs treat them identically and, in contrast to now, at the time, most interconnection queues did not have enough projects to meet RPS targets.

In general, that figure is really striking to me and to me, says something about the costs of solar + subsidy support relative to the marginal generation technology. It would be interesting to compare these numbers to the generation due to new wind capacity (deployed after 2009) and new CCGT capacity (same time frame). My guess is that, even accounting for capacity factors, there is a transformational change happening here. But then, I live in the green line of your figure and where I work, it seems like every third car in the garage was manufactured by Elon Musk.

Solar City amortizing the cost with the electricity itself.

The local utility’s rate design and net metering rules would have an impact on the economics of distributed roof top solar. If the PSC allowed higher fixed charges ( closer to cost of service) then KWh charges would be lower. Result would be lower kWh savings. Less solar investment.

Thank you all for these very thoughtful observations and cautions. We are going to tease out the RPS and net metering details, and we want to put together a panel so we can see when the regulation changed as well as the specific net metering rates.

Back in 2012 EIA said they were going to start including customer-sited MW from the EIA-861 forms, but yeah, Michael, I’m inclined to use SEIA data instead. These data, however, are suggestive.

This may well not have any relevance at all to your work but there was a huge technical change on the supply side. Something that drive a lot of the price reduction of panels and thus had an effect on adoption in general but not necessarily on adoption by area.

The basic raw ingredient for most solar (not Cd/Te, obviously) is pure silicon metal. Traditionally this was provided by the tops and tails and the rejects from the computer chip industry (tops and tails….you make an ingot and part of the purification process concentrates impurities at the ends of the ingot. These are still pure enough for solar but not for chips.) Solar grew bigger and this source was no longer large enough. Prices for silicon ingot hit $450 per kg at one point. Doesn’t make any real difference to the computer industry, value added is so high. But a problem for solar.

Manufacturers pondered and experimented and current cost is $20 per kg or so ($30 with full capital costs, there’s oversupply at present). A variety of techniques used to get that price down. Making in larger ingots for example, just getting the whole supply chain of high purity silica (the raw material for the ingots themselves and also for the crucibles they are made in) sorted and so on. Probably the biggest technical step was in working out how to bring down quality. Chips require up to 99.9999999999 % purity. Solar is happy with 99.99999%. Working out how to make the lower quality more cheaply took time.

As I say, this might not be relevant for looking at the effect of different policies in different places. But this is a large part of the overall price decline. Economies of scale, getting serious about what the industry really needs etc etc.