Lynne Kiesling

I was glad Mike mentioned Alex Tabarrok’s recent Launching the Innovation Renaissance in his recent post on the Honeywell-Next patent lawsuit, because reading Alex’s new TED book was on my to-do list for this past weekend. Alex’s focus in this book is U.S. innovation policy and ways that we could improve the institutional environment to better enable innovation to create opportunities for people to thrive, and consequently to create growth. He analyzes the patent system, education, and how the federal warfare-welfare state has a high opportunity cost in terms of resources that could be dedicated to R&D (through both public and private funding) but aren’t because of the heavy burden of defense and entitlement spending.

An important variable on which Alex focuses is the ratio of development costs to imitation costs, and he argues that laws such as patents are more likely to be positive-sum and pro-growth in industries with high development costs and low imitation costs. He discusses pharmaceuticals as the canonical industry in this category, where the absence of patents would be likely to reduce the amount of new drug development. But patents in other industries with lower development costs and lower imitation costs can hinder innovation, because they discourage the use of ideas in novel, unexpected ways by people other than the patent-holder. Moreover, notice the dynamic incentives that the current patent system presents to engage mostly in defensive patenting, which is wasteful and reduces the extent to which patents are positive-sum. The high-profile activities of patent trolls in technology-related industries in the past decade indicates just how wasteful this perverse incentive is.

One of Alex’s recommendations to reform the patent systems is variable patent duration in accordance with these differences in development costs and imitation costs. For example, from the book, one-click shopping and a pharmaceutical that cost millions of dollars to develop both receive 20-year patents. Uniform patent length means that the patent system ignores the importance of both development costs and imitation costs in determining whether the monopoly granted by the patent will be positive-sum or not. Granting different monopoly lengths depending on the interplay of development costs and imitation costs in that industry when the invention is created would enable developers to recoup costs while reducing the lost beneficial applications of imitation. Note in particular that a lot of these beneficial applications are not direct imitation, but are rather creative uses of the idea as an input into some other idea. Patents that are either too long or too broad (or both) deter such beneficial activity.

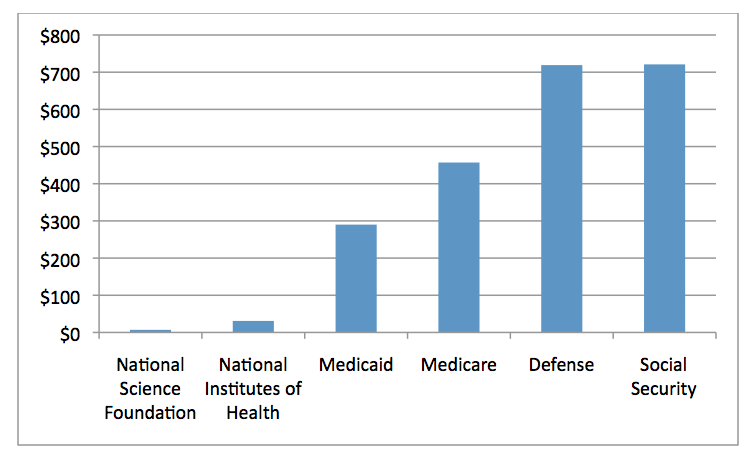

For brevity I’ll skip over his thought-provoking discussion of education (but I do recommend it to your attention), and connect the patent discussion to the implications of federal warfare-welfare spending for whether or not we have an institutional environment that is conducive to unleashing innovation. Alex presents some sobering data on federal government spending on research, entitlements, and defense, data that he elaborates on in a post at Marginal Revolution today in which he puts a NY Times article on the welfare state in the context of his argument.

And that doesn’t even take into account the important, but trickier to estimate, effect of government spending on private R&D funding (the crowding out question). Crowding out can take two forms — government spending on R&D reducing private R&D spending, or government spending on other goods and services reducing the resources available for private R&D spending.

And that doesn’t even take into account the important, but trickier to estimate, effect of government spending on private R&D funding (the crowding out question). Crowding out can take two forms — government spending on R&D reducing private R&D spending, or government spending on other goods and services reducing the resources available for private R&D spending.

Alex boldly makes what I think is the crucial material point:

The point is not simply that the U.S. should spend more money but that a state with these kinds of budget priorities does not have innovation at the center of its vision. If innovation is not central to the vision, then it is inevitably given short shrift.

Given the incontrovertible evidence that low barriers to innovation are the biggest ultimate institutional cause of the unprecedented growth in well-being and living standards over the past 250 years, the absence of this innovation vision is backward-looking and short-sighted.

Alex also highlights the extent to which regulatory thickets generate wasteful spending, particularly in health care and energy. Money we could spend on medical research and basic energy research gets spent instead on regulation-induced bureaucracy and wasteful projects like Solyndra and others that have failed. Reducing these regulatory thickets and focusing more vision on innovation and basic research than on bureaucratically-weighted and centrally planned projects would be an important incremental move in the right direction. To the extent we’re going to have a state, we should move from a warfare-welfare state to an innovation state.

Sadly, I think Alex is right about the political economy of innovation when he notes that “… few people lobby for innovation because almost by definition, innovation creates present losers and future winners and the present losers are by far the more politically powerful. Innovation has few champions.”

The book closes with seven institutional/policy recommendations touching on patent reform, education, regulation, and open trade in goods, services, and ideas. These recommendations also have implications for issues like immigration and health care.

One of the most valuable features of this book is how well written it is. While being a short, easy, compelling read, it’s a book dense with good and thought-provoking ideas presented clearly for non-specialists (and backed up by extensive references at the end for further analysis). I don’t remember where I saw it, but I think someone commented that we should send a copy of Alex’s book to every member of Congress and their staffers. That would be a valuable education process.

See also a short essay drawn from the book, and listen to Alex’s EconTalk podcast with Russ Roberts discussing the book.

Every public good has opportunity costs. Have you ever considered the value of tax choice?

http://en.wikipedia.org/wiki/Tax_choice